35+ Roth conversion tax calculator 2020

This limit is per participant. Division O section 111 of PL.

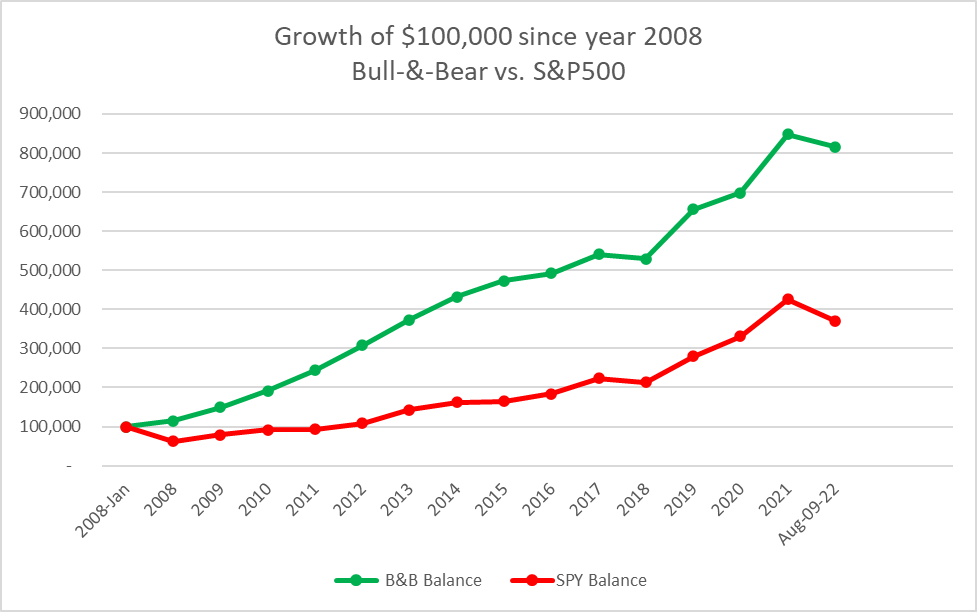

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

15 for qualified dividends and long-term gains.

. 6000 7000 if youre age 50 or older. It makes the effective marginal tax rate on the additional 10000 income 27 not 12. Compare that tax rate to the marginal tax rate.

In 2021 she makes a 2000 contribution that may be partly nondeductible. A distribution made before the end of the 5-tax-year period beginning with the first tax year for which you made a designated Roth contribution to the account isnt a qualified distribution. She also receives a distribution of 5000 for conversion to a Roth IRA.

Though Sg and India has double tax avoidance will I be calculated to pay as per 30 slab and deduct Sg tax and pay rest in India BR Siva. So if your spouse is earning money from your small business that means your spouse can also. Will I need to pay Tax for salary income earned in Singapore.

Publication 590-B 2020 Distributions from Individual Retirement Arrangements IRAs Internal Revenue Service. A Roth IRA conversion is a way to move money from a traditional SEP or SIMPLE IRA or a defined-contribution plan like a 401k into a Roth IRA. When figuring out what tax bracket youre in you look at the highest tax rate applied to the top portion of your taxable income for your filing status.

Pretax andor after-tax Roth funds both make up employee deferral contributions. 750000 From 5335 per month 1000000 From 7064 per month Premiums shown are for a 20-year SimplyTerm ICC20 SIMPT-2020 or SIMPT-2020 policy issued by Pruco Life Insurance Company Newark NJ for a Male age 35 based on the Preferred Best underwriting category. Retirement Topics - Exceptions to Tax on Early Distributions Accessed Mar.

After-tax returns are net of federal taxes only and they exclude the impact of capital gains resulting from liquidation. 35 through 3909 40 through 4410. If you didnt add the excess deferral amount to your wages on your 2020 tax return you must file an amended.

35 for interest and short-term gains. President Joe Bidens 2022 budget proposal raises the top income tax rate up to 396. The federal income tax system is progressive which means that tax rates go up the greater taxable income you have.

If you are married and your spouse is covered by a retirement plan at work and you arent and you live with your spouse or file a joint return your deduction is phased out if your modified AGI is more than 204000 up from 198000 for 2021 but less than 214000 up from 208000 for 2021. Are There Tax Consequences of Rolling a 401k Into a. This is up from 57000 and 63500 in 2020.

Right now the best path IMO is pre-tax in your 40K up to match then Roth IRA if your income is low enough then max out the 401K pretax then taxable. Married filing jointly or qualifying widower Less than 204000. The term tax bracket refers to the income ranges with differing tax rates applied to each range.

2022 Roth IRA Income Limits. So Ill become RNOR. The federal Residential Energy Efficient Property Credit income tax credit on IRS Form 5695 for residential PV and solar thermal was extended in December 2015 to remain at 30 of system cost parts and installation for systems put into service by the end of 2019 then 26 until the end of 2020 and then 22 until the end of 2021.

If early is 60 you can still go by that simple guidance. To contribute to a Roth IRA in 2022 single tax filers must have a modified adjusted gross income MAGI of 144000 or less up from. Solo 401k Retirement Calculator.

I do work from home. IRS Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More. Whirlpool Refrigerator Led Lights Flashing.

Normally its a good idea to consider Roth conversion or harvesting tax gains in the 12 tax bracket but those moves become much less attractive when you receive a premium subsidy for the ACA health insurance. The cliff is low when you are young. Modified AGI limit for certain married individuals increased.

I may exceed 120 days. In the end your going to want a mix or Roth Tax-deferred and taxable. Recharacterizing could save you money if the IRA has lost money since the time of the original conversion.

116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after separation from the. Roth Conversion Calculator. Go to a tax calculator and calculate the taxes on 150k of income.

She completed the conversion before December 31 2021 and didnt recharacterize any contributions. Traditional-to-Roth IRA Conversion Tax Guide. If early is 40 converting tax-deferred money to Roth is more important.

Taxpayers with an adjusted gross income over 1 million will also have to pay this rate on long-term. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. If you converted a traditional IRA to a Roth IRA during 2019 and paid tax on the conversion with your 2019 return your deadline for recharacterizing undoing the conversion is October 15 2020.

Its easier to avoid the cliff. You can contribute up to 6000 each year to your Roth IRA in tax years 2021 and 2022. A large part of spending down taxable funds isnt taxable.

After switching to LEDs or when replacing a faulty LED lamp in some cases the LED light will start flickering We will explain temperature settings alarm sounds door not closing water filter changes not cooling issues not making ice no power strange sounds leveling ice makers water dispensers This refrigerator has the. However for the 2021 tax year the maximum credit percentage jumps from 35 to 50 up to 8000 in expenses for one child and 16000 for multiple children qualify for the credit the phase-out. Filing Status 2022 Modified AGI Contribution Limit.

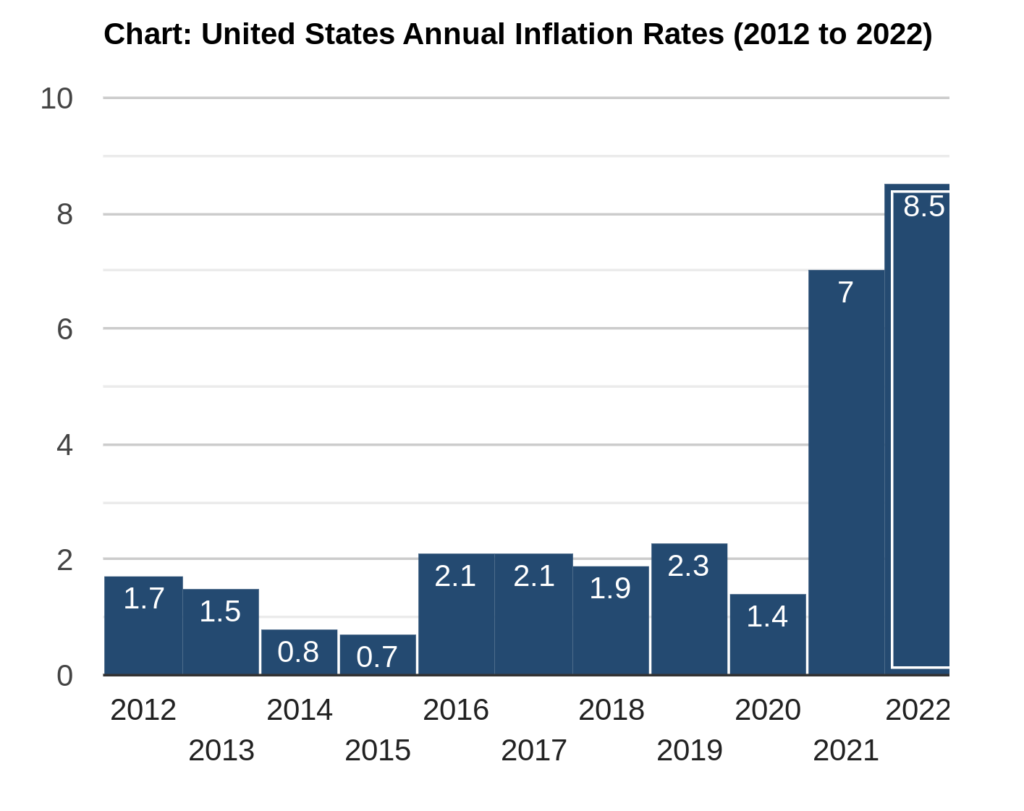

Workers say pay isnt keeping up with inflation More than half of employees who recently got raises said they werent high enough to cover rising expenses survey finds. Use our Roth IRA calculator to discover how much you could save in. In 2020 oct I came to India and couldnt return to Spore.

557 Additional Tax on Early Distributions from Traditional and Roth IRAs Accessed June 19 2020. A Roth IRA conversion turns a traditional IRA into a Roth which may bring tax savings and let investments grow tax-free. At the end of 2021 the fair market values of her accounts including earnings total 20000.

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

:max_bytes(150000):strip_icc()/aetna-vs-cigna-health-insurance.asp_V2-222f398d5d934526b84ed78eefde3038.png)

How To Compare Health Insurance Plans Aetna Vs Cigna

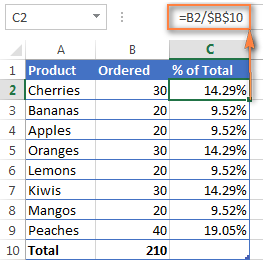

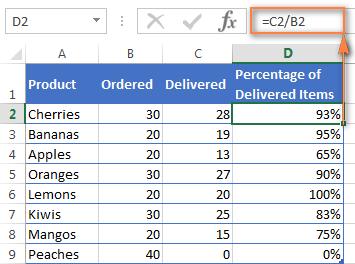

How To Calculate Percentage Of Marks

What Are Roth Ira Accounts Nerdwallet Roth Ira Ira Investment Individual Retirement Account

1

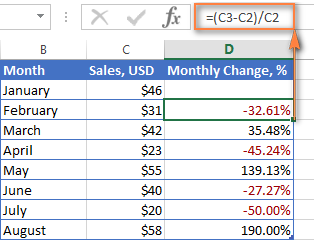

How To Calculate Percentage In Excel Percent Formula Examples

Is It Worth It To Have An Ira Even Though I M In My Twenties Quora

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

What Is The Best Company With Which To Open An Ira Account And Why Quora

May 2022 National Survey Nearly 4 In 5 Americans Haven T Taken Action To Hedge Against Inflation 14 6 Have Added Real Assets

Does Converting To A Roth Ira Make Sense If You Think You Ll Be In An Equal Or Lower Tax Bracket After Retirement Quora

How To Calculate Percentage In Excel Percent Formula Examples

1

How To Calculate Percentage In Excel Percent Formula Examples

1

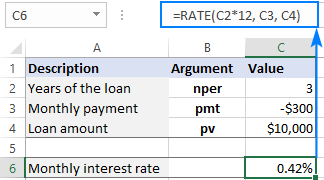

Using Rate Function In Excel To Calculate Interest Rate